A strong credit score is the foundation of a healthy financial future. Whether you’re applying for a new credit card, a car loan, or a home loan, your score will play a big role in whether you get approved—and at what interest rate. If you’ve been wondering how to improve credit score, the process requires consistency, but with the right steps, it’s absolutely achievable.

Why Credit Scores Matter

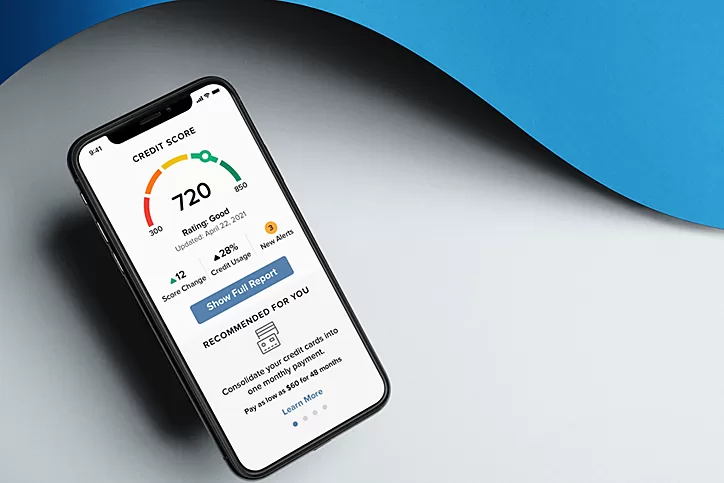

Your credit score reflects your repayment behavior, credit utilization, and financial discipline. Lenders view it as a measure of your trustworthiness. A score above 750 often means quick approvals, higher credit limits, and lower interest rates. On the other hand, a weak score can make borrowing expensive and stressful.

Practical Steps to Improve Credit Score

- Pay EMIs and Bills on Time: Even a single missed payment can lower your score.

- Lower Your Credit Utilization: Use less than 30% of your total available credit.

- Avoid Frequent Applications: Too many loan or card applications create negative hard inquiries.

- Review Your Report Regularly: Errors are common—dispute them early to protect your score.

- Maintain a Good Credit Mix: A balance of secured (like home loans) and unsecured (like credit cards) loans improves your profile.

How to Improve CIBIL Score with Smart Tracking

If you’re focused on how to improve CIBIL score, the same strategies apply but require more consistent monitoring. CIBIL reports often reflect updates from lenders within weeks, so actively checking your report helps you identify what’s working and where to adjust.

Using Technology to Speed Up Results

AI-powered tools can analyze your report, highlight problem areas, and provide a personalized action plan. Instead of generic advice, you get clear guidance based on your unique financial situation. For example, it may recommend paying off certain high-interest cards first or setting reminders for recurring payments.

Benefits of a Higher Score

- Access to loans at lower interest rates.

- Higher approval chances for credit cards and premium products.

- Greater financial flexibility and peace of mind.

- Stronger credibility with lenders for future needs.

Final Thoughts

Improving your credit score is not a mystery—it’s about building habits that demonstrate responsibility. By paying bills on time, lowering utilization, and using AI-powered insights, you can steadily climb toward and maintain a 750+ score.

If you’ve been asking how to improve credit score or specifically your CIBIL score, the answer lies in discipline and smart tools. Start today, and you’ll thank yourself tomorrow for securing a stronger financial foundation.